Core capabilities:

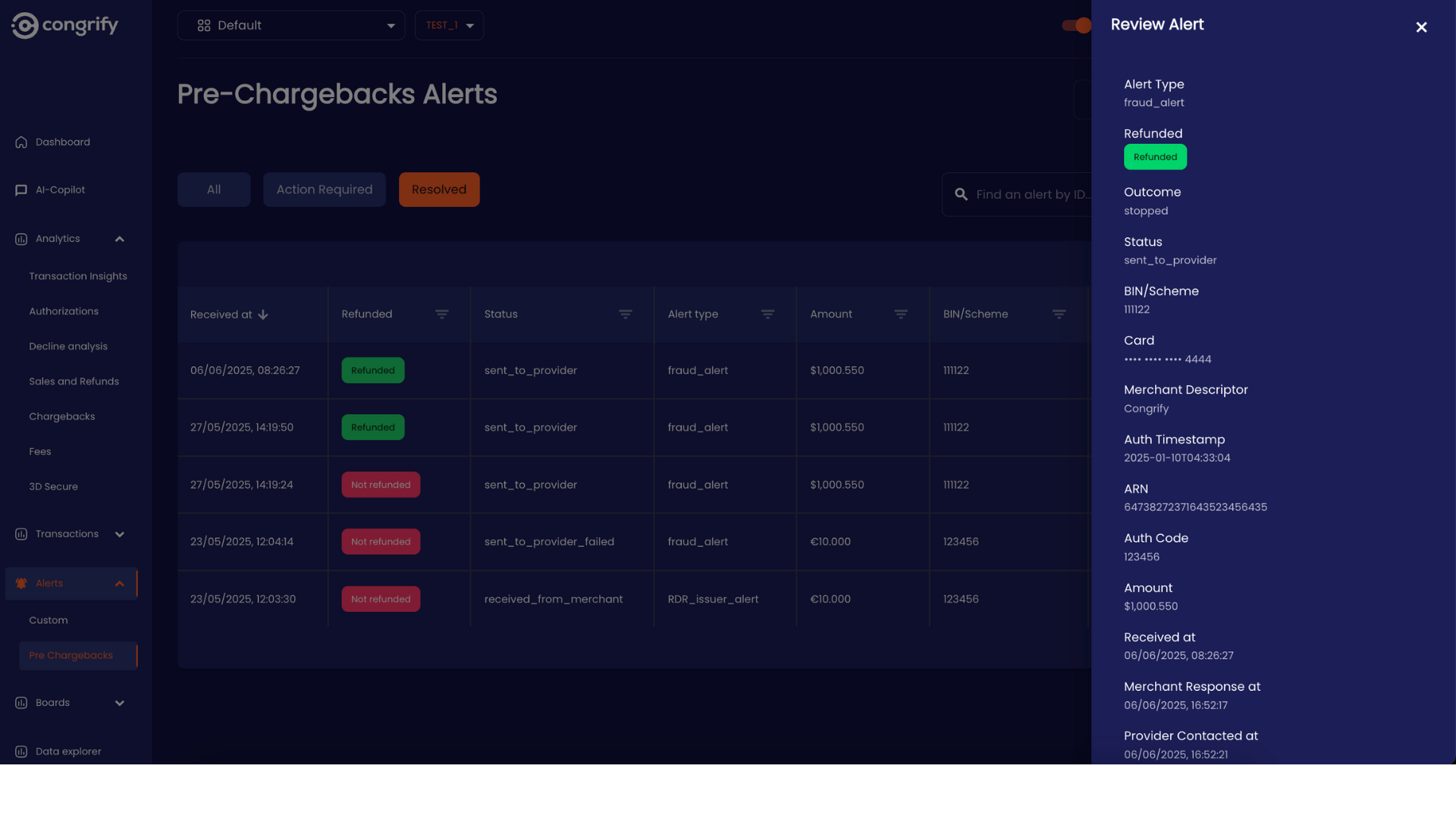

Pre-chargeback notifications

Receive a notification via email or a Slack alert as soon as a pre-chargeback alert from Ethoca and Verifi has been initiated.

Centralized Chargeback Monitoring

Track all the received alerts and take actions directly from our portal or via API.

Smart Insights & Trends

Check the trends and patterns of your chargeback pre-alerts and final disputes from your PSPs.

Main Features:

Automated Processes.

Take action directly in the Congrify portal or automate responses via API, email, Slack alerts, or webhooks—flexible options to fit your existing workflows.Why Chargeback Prevention Matters?

Monitor Trends and Patterns.

Excessive chargebacks can jeopardize your business’s ability to process payments, as payment acquirers may terminate accounts with high chargeback ratios to mitigate risk. Proactively addressing pre-chargeback alerts can significantly reduce the number of formal chargebacks reported to card scheme monitoring programs, helping maintain compliance and protect your merchant account status.Operational Expenses.

Pre-chargeback alerts are usually expensive, often even more costly than processing standard chargebacks themselves. However, the key advantage is that they allow businesses to act quickly and potentially prevent the chargeback from being filed in the first place. This proactive approach saves significant time and operational resources.Reputational Risk.

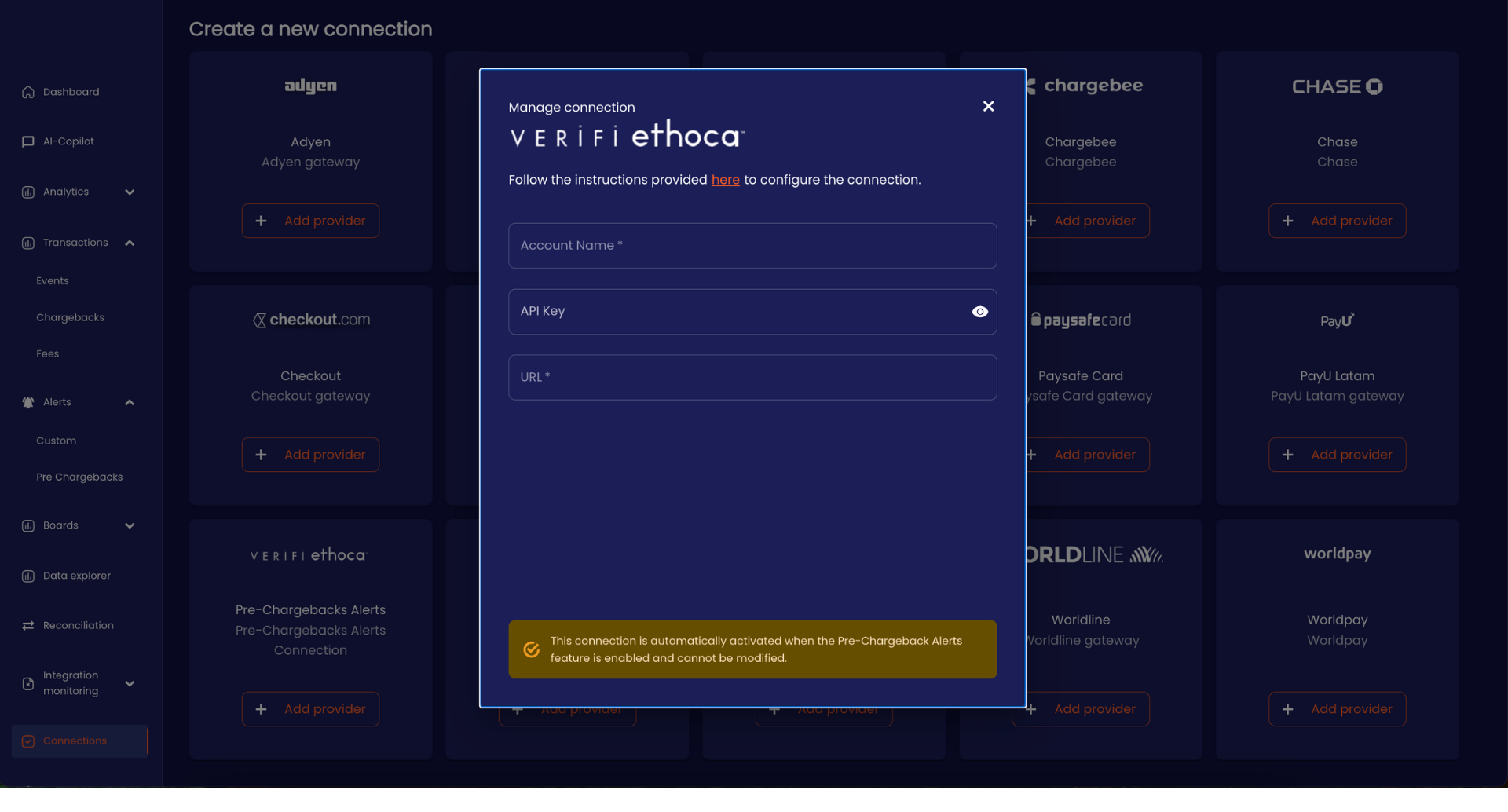

Frequent chargebacks can harm your brand’s credibility, signaling unreliability to customers, PSPs, and card networks. A high chargeback rate may lead to restrictions, higher fees, or even loss of payment processing privileges. Congrify’s AI-powered anomaly detection and predictive insights help you maintain low chargeback ratios by addressing root causes, such as fraud or poor transaction clarity.No-Code PSP Connections.

Congrify supports more than 20 different connections to payment service providers and data sources. We integrate directly to the most used global PSPs such as: