How to Monitor and Prevent Chargebacks in 2025

By Rihab Oudda (July 15, 2025)

Chargebacks: A Threat You Can Tackle with Proactive Monitoring

As a merchant, there is always the “chargeback discovery moment”. That’s the time when you discover that disputes can be higher than expected and harm your business much more than your organization had thought until that moment.

But what are chargebacks? The official definition is: A chargeback is a forced refund initiated when a cardholder disputes a debit or credit card transaction, prompting the card issuer to reverse the payment back to the customer. But chargebacks are much more – they are an escalating challenge for businesses, with high fees and the hidden costs of operational disruptions like staff time spent on resolutions. A study by Mastercard predicts a 24% surge in chargeback volumes by 2028 (read more here). These disputes don’t just hit the wallet; they erode profitability by diverting resources from growth initiatives and strain customer relationships, particularly when driven by fraud or dissatisfaction. The stakes are high, with potential penalties from payment processors looming for those unable to manage dispute levels effectively.

That’s why proactive monitoring is essential. In this blog post, we are deep diving into how to monitor chargebacks correctly, how those impact your business, and how solutions such as Congrify can help you in this never-ending challenge.

How Do Chargebacks Impact Your Business?

Chargebacks deliver a multi-layered blow to businesses, impacting finances, operations, and customer trust in ways that can derail long-term success if not addressed properly.

- Financially, each chargeback strips away the transaction amount, adds fees of $15 to $100 per dispute, and incurs operational costs ranging from $15-$70, according the Mastercard.

- Operationally, the time and effort required to handle disputes pull focus from core business activities, creating inefficiencies that hinder growth.

- Reputationally, a high chargeback ratio raises red flags with payment processors, potentially triggering higher interchange fees, stricter transaction limits, or even account closure.

- Customer relationships take a hit as well, with disputes stemming from friendly fraud (e.g., unrecognized charges) or service issues (e.g., non-delivery) eroding loyalty and repeat business. Industry data highlights the severity, showing fraud-related chargebacks costing businesses $3.75 for every $1 lost.

In today’s tightening regulatory landscape, these impacts underscore the urgent need for proactive monitoring and prevention to safeguard profitability and market standing.

What’s Important to Monitor?

To effectively manage chargebacks, merchants must track key metrics to detect risks and ensure compliance with card scheme program requirements.

- Fraud Rates: Monitor fraud reports (i.e., TC40/SAFE reports with unauthorized fraudulent transactions) to identify patterns driving chargebacks, aligning with card scheme programs focus on fraud reduction.

- Chargeback Rates by Original Payment Dates: Analyze disputes relative to transaction dates to uncover delays or recurring issues, such as delivery disputes or specific time-related patterns.

- Chargeback Rates by Card Scheme Programs: Track compliance with card scheme program thresholds to avoid penalties, ensuring alignment with the specific card scheme logics and calculations.

Beyond the core metrics and what is being monitored, it’s fundamental to have the capabilities to go into details and have well-organized data that will allow you to group the different KPIs by the following dimensions:

- PSP or gateway

- Merchant account, MCCs, MIDs

- Card issuer information (Scheme, BIN, Issuer Country, Card Type, Card Product)

- Payment type (first time/recurring)

- Customer information (Customer IDs, Customer Type)

- Order information (Order ID, Checkout information)

Why is it important to monitor?

Monitoring these metrics is crucial for several reasons, as it empowers merchants to protect their businesses proactively:

- Tracking fraud rates helps identify vulnerabilities, such as card testing or unauthorized transactions, which can spiral into costly chargeback disputes if unaddressed, especially as fraud accounts for a significant portion of chargeback volume.

- Analyzing chargeback rates by original payment dates reveals operational inefficiencies, like delayed shipping, allowing merchants to address root causes before they escalate into widespread issues.

- Monitoring chargeback rates by card scheme programs ensures compliance with evolving regulations, such as Visa’s VAMP thresholds, preventing penalties like increased fees or account restrictions that could jeopardize business operations.

In a landscape where chargeback volumes are expected to rise, staying ahead through consistent monitoring not only mitigates financial losses but also strengthens customer trust and operational resilience, making it an indispensable strategy for sustainable growth. Monitoring chargebacks requires proactivity, so it’s important not only to have the data available and structured in the right way, but it also requires advanced alerting engines that can be customized according to your needs to make sure that you are informed quickly and in a timely manner in case of chargeback anomalies.

The New Visa Acquirer Monitoring Program (VAMP)

How Is VAMP Calculated?

Effective June 1, 2025, VAMP consolidates the Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP).

According to the Official Visa Acquirer Monitoring Program Overview:

VAMP Ratio = Count of [Fraud (TC40) + Disputes (TC15)] ÷ Count of Settled Transactions (TC05)

VAMP Ratio has additional criteria:

- Excludes disputes resolved through pre-dispute solutions, contingent on the timing of the data extract.

- Excludes TC 40 fraud qualified for Compelling Evidence 3.0, contingent on the timing of the data extract.

How Can VAMP Impact You?

Exceeding VAMP thresholds can have significant consequences for merchants:

- Fines and Fees: From October 1, 2025, merchants are charged $8 per CNP dispute, regardless of fraud or non-fraud classification.* Merchants with five or fewer disputes monthly remain fee-exempt. A three-month grace period applies for first-time offenders within a 12-month period to adjust practices.

*Fees subject to change according to Visa/Acquirers.

- Reputational and Operational Risks: High ratios may lead to higher processing fees, acquirer-imposed stricter limits, or Visa disqualification, disrupting revenue.

- Enforcement Timeline: Excessive threshold enforcement begins October 1, 2025; Above Standard starts January 1, 2026; Merchant Excessive reductions apply from April 1, 2026.

How Does Congrify Help Monitor Chargebacks According to VAMP?

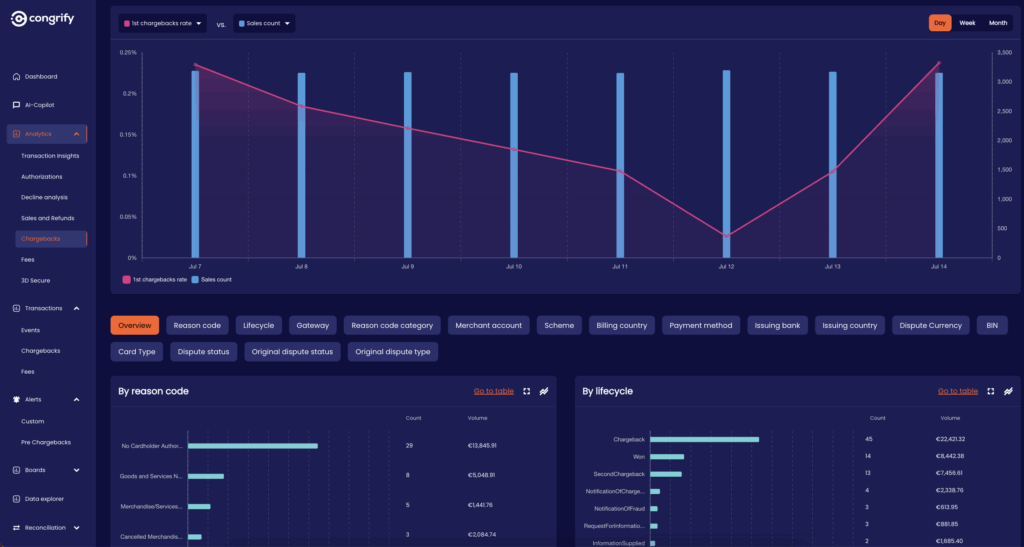

Congrify’s VAMP-specific dashboard simplifies compliance with Visa’s updated 2025 standards, offering:

- Granular Insights: Analyzes chargebacks by reason codes, PSPs, issuer countries, card products, and MIDs to pinpoint VAMP-related risks.

- Near Real-Time Tracking: Monitors VAMP Ratio (TC40 + TC15 ÷ TC05) and Enumeration Ratio, alerting merchants when nearing any of their chosen tresholds.

- Compliance Alerts: Notifies merchants of potential VAMP enrollment risks, enabling proactive remediation with acquirers to avoid fines.

How Does Congrify Help Prevent Chargebacks?

Congrify’s AI-driven tools prevent chargebacks before they impact VAMP ratios:

- Chargeback Pre-Alerts: Integrates with Ethoca and Verifi to deliver real-time alerts (email, Slack, API) within 24-72 hours, enabling refunds or resolutions to prevent chargebacks.

- Centralized Fraud Notifications: Aggregates fraud and dispute alerts from 20+ PSPs into one platform, streamlining fraud management to reduce VAMP-related disputes.

- Custom Monitoring Alerts: Tracks spikes in fraud, chargebacks, and VAMP ratios across PSPs, card schemes, issuer countries, card products, and MIDs, supporting early intervention.

Wrapping Up

Chargebacks threaten profitability and Visa compliance, but Congrify’s AI-powered payments intelligence and pre-chargeback alerts make monitoring and prevention seamless in 2025. By tracking VAMP metrics, fraud rates, and chargeback trends, Congrify helps merchants stay below the 0.9% threshold, avoiding fines and reputational risks.

Don’t wait until the VAMP enforcements; proactive monitoring is critical to avoid these penalties, and we are here to help you protect your revenues. You can also simply sign up for a free Congrify demo to try it out for yourself!