AI in Payments: How to Simplify Payments Observability

Discover how AI in payments observability simplifies payment declines and analytics with Congrify’s AI Co-Pilot.

By Rihab Oudda

Payment observability, a cornerstone of efficient financial operations, often overwhelms merchants due to scattered data and complex setups. At Congrify, we’re transforming this with AI in payments through our AI Co-Pilot—a tool that delivers instant payments intelligence to simplify the chaos. Here’s how AI Co-Pilot empowers payments people to focus on what matters most.

Tackling the Biggest Challenges in Payment Observability

Payment observability often feels like searching for a needle in a haystack. Merchants struggle with fragmented datasets across multiple payment service providers (PSPs), making it hard to access data quickly or find actionable insights without advanced analytics skills. Understanding complex patterns—like conversion rates or decline reason codes across various merchant accounts, payment methods, and customer segments—can be a nightmare. Add to that the time it takes to merge scattered data sources, and you’ve got a recipe for inefficiency.

AI Co-Pilot was built to address these pain points head-on. It provides simple access to continuously refreshed payment data from PSP ingestion services, operating in near real-time. AI Co-Pilot enhances payments monitoring by running in the background, checking specific patterns and user-defined KPIs to deliver insights without requiring data querying expertise. Whether it’s spotting anomalies in conversion rates, analyzing scheme fees to identify unexpected cost spikes, or understanding payment declines through normalized decline reason codes across hundreds of data combinations, AI Co-Pilot simplifies the process, guiding users to the exact issues that need attention.

Simplifying Payment Observability for Finance Teams

Traditional payment observability methods are time-intensive and error-prone. Finance teams often rely on extensive dashboards that require hours of analysis, data interpretation, and manual cross-referencing of multiple tables. If the data isn’t sufficient, teams must hunt for additional sources outside their business intelligence tools, for example needing to log into multiple PSP portals, downloading CSV files, and ending up woking in excel—a process that’s both frustrating and inefficient.

AI Co-Pilot flips this on its head. It has full access to payment data from PSPs, meaning there’s no need to search for additional sources. Users can simply ask questions, and AI Co-Pilot leverages payment analytics to deliver tailored insights, such as identifying anomalies in authorization rates over the past week, without the need for manual data wrangling. For example, let’s say you want to analyze anomalies in payment authorization rates over the past week. With traditional methods, you’d need to:

- Access a business intelligence tool and ensure all PSP data is available.

- Verify that authorization rate calculations are mapped correctly.

- Build a table with dimensions like merchant account, payment method, and customer country.

- Manually analyze daily data for spikes across hundreds of combinations.

This could take hours. With AI Co-Pilot, it’s as simple as asking:

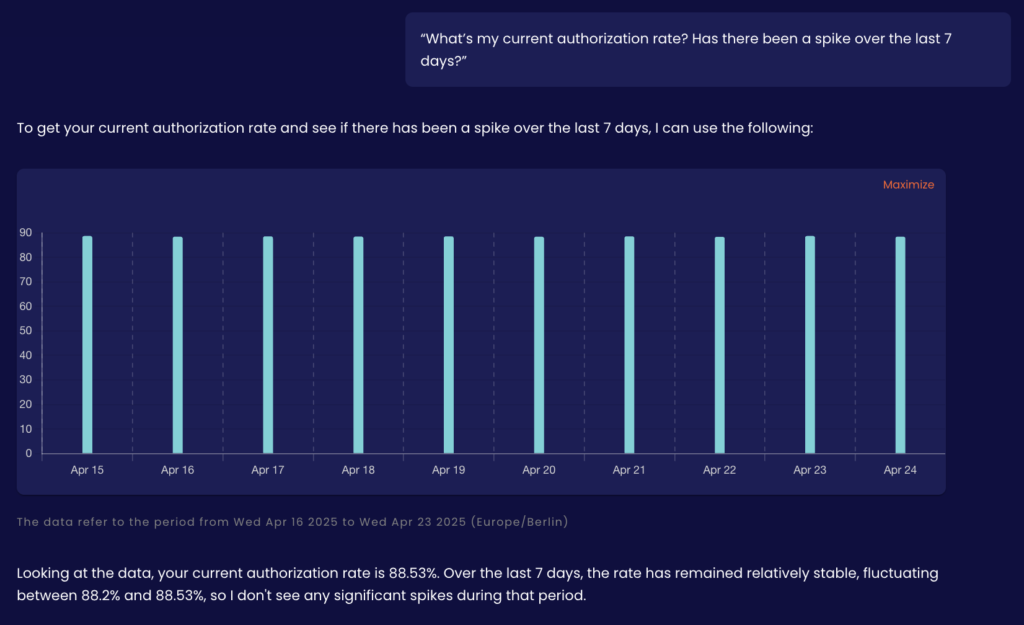

- “What’s my current authorization rate? Has there been a spike over the last 7 days?”

- “If yes, which combination of payment method, merchant account, and country is affected?”

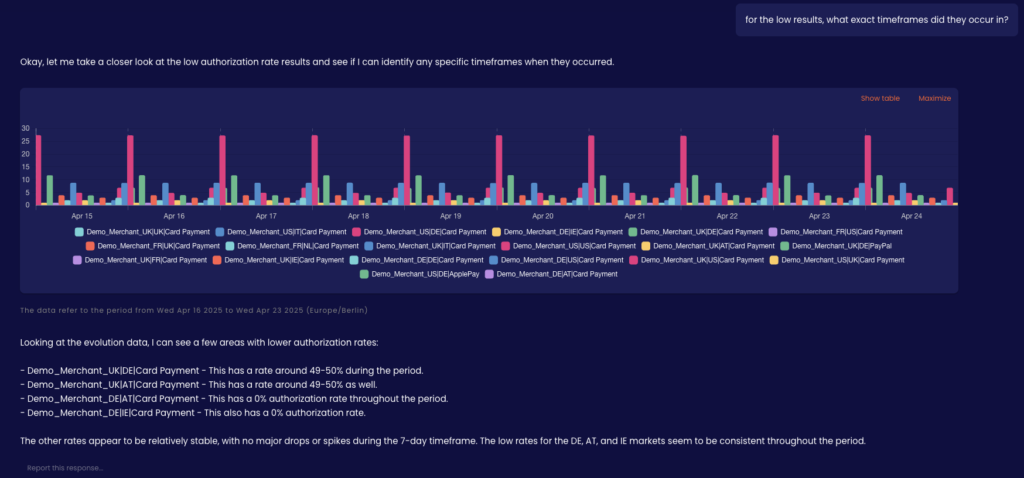

- “For the low results, what exact timeframes did they occur in?”

In minutes, AI Co-Pilot delivers the answers, saving significant time and eliminating the need for manual analysis. The user experience is intuitive—insights are presented through conversational responses, making complex data accessible to everyone, not just data experts.

Real-World Impact: Catching Payment Issues Before They Escalate

Imagine an e-commerce business processing thousands of transactions daily. One morning, a payment operations manager uses AI Co-Pilot to run a routine check: “Are there any new decline reason codes in the last 24 hours?” AI Co-Pilot instantly identifies a new decline code causing payment declines in a small but growing number of transactions, while also flagging unexpected increases in gateway and interchange fees across specific merchant accounts, payment methods, and customer segments, delivering the kind of clarity highlighted in our AI Co-Pilot for payments overview—issues that might have been missed due to the level of granularity of the patterns by traditional payments monitoring tools. By catching the problem early, the team adjusts their payment management strategy—potentially saving thousands in lost revenue and additional costs—before customer service escalations pile up.

This is just one example of AI Co-Pilot’s impact. Users can expect greater control and confidence in their payment decisions, more visibility into their data, and unprecedented levels of detail that typically require hours of analysis or an experienced payment analyst. The result? Significant time savings, fewer payment errors, and the ability to unlock insights that drive smarter business strategies.

What Sets AI Co-Pilot Apart

Unlike other AI tools and engines that often focus on fraud prevention, KYC, or compliance, AI Co-Pilot is uniquely designed for payment analytics and cost management, helping users optimize expenses by identifying patterns like unexpected spikes in gateway, scheme or interchange fees, or conversion rate anomalies. Its ability to merge and combine scattered datasets ensures no insight is left behind, no matter how complex the setup.

Integration is seamless. Congrify connects directly to a company’s PSP data sources, requiring no additional integration effort. Companies can opt for data enrichment via secure file sharing or API, but the core setup is plug-and-play. AI Co-Pilot adapts to any industry—fintech, e-commerce, SaaS, or beyond—as long as payments data is involved, making it versatile for businesses of all types.

The Future of Payment Observability with AI Co-Pilot

We’re just getting started. At Congrify, we’re working on a multi-agent infrastructure that will allow AI Co-Pilot to act as an advanced payments analyst, delivering payments intelligence through dedicated dashboards, special summaries, and advanced data exploration with over 99% accuracy in question and answer interpretation that we are currently working towards—an evolution of the vision we shared in building a data co-pilot for payments. Our goal is to make payment observability not just simpler, but smarter, giving payment professionals the tools to focus on strategy, not data wrangling.

Ready to Simplify Your Payment Observability?

AI Co-Pilot is more than a tool—it’s a partner for payment professionals, delivering instant insights that transform complexity into clarity. Whether you’re managing multiple merchant accounts or tracking decline reason codes, AI Co-Pilot empowers you with the intelligence to make faster, better decisions.

Want to see it in action? Book a demo today and discover how AI Co-Pilot can simplify your payment observability—before your next coffee break. For a deeper dive into its capabilities, check out our AI Co-Pilot for payments overview.