Costs in payments – part 1: blended vs interchange ++ pricing

By Marco Conte

The payment industry is a complex ecosystem, encompassing a myriad of stakeholders from banks and payment service providers (PSPs) to merchants and consumers, with costs being critical in determining the efficiency and sustainability of operations. Ultimately, costs can significantly impact a company’s bottom line. Prior to founding Congrify, our team has spent years working in developing PSPs or implementing and managing payments. We consider costs and payments as an essential topic that needs transparency and to be demystified in the industry. This six part series explores the pivotal role of costs in the payment industry, highlighting why businesses must prioritize cost analysis and optimization to thrive in this highly competitive sector.

Throughout this series, we will delve deeper into the topic of costs through breaking down the multitude of its topics and sectors. Let’s kickoff this conversation with the basics – the concept of pricing models.

Interchange ++ vs Blended pricing models

Choosing the right pricing model is an essential strategy for companies. Especially for those willing to accept online payments or have a platform offering payment acceptance services to other businesses, the choice impacts business goals and overall competitiveness. But in order to know which is the best fit, we must first understand the basic differences in pricing models for the payment industry and their drivers.

Interchange ++ and blended are two of the most common pricing models businesses opt to utilize.

Interchange Plus Plus pricing (IC ++)

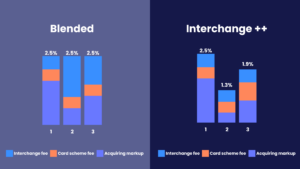

This model essentially breaks apart card processing fees into three parts: an interchange fee, a card scheme fee, and a processing fee.

- Interchange fee – During a transaction, a cardholder’s bank (as well known as the issuing bank) will charge the acquirer an interchange fee. Ultimately, this interchange fee becomes included in the acquirer’s payment processing fees, passing the cost onto the merchant. The interchange fee compensates the issuing bank for the risk and cost of handling card transactions, including the cost of fraud prevention, credit risk, and maintaining the cardholder’s account. These fees are set by local regulators (for example Europe caps them at 0.20% for debit cards and 0.30% for credit cards), card networks (such as Visa, MasterCard, and American Express), and can vary based on several factors, including the type of card used (credit, debit, consumer, business), the transaction type (in-store, online), and the merchant’s industry.

- Card scheme fee – Card schemes (such as Visa, MasterCard, and American Express) impose a charge on the acquiring bank that processes card payments. In some cases it can also be paid by issuing banks (cardholder’s banks) to the card networks for the use of their payment processing infrastructure and services. Card scheme fees help cover the costs of maintaining and operating the card networks’ infrastructure, which includes payment processing systems, security measures, and enables innovation initiatives. These fees ensure that the card networks can provide reliable and efficient services to facilitate card transactions globally. Card scheme fees are typically calculated as a small percentage of the transaction amount, and they can vary based on the card network, the type of card used (credit, debit, premium, etc.), and the merchant’s region or industry. Some networks may also charge a flat fee per transaction.

- Acquiring markup – Payment acquirers impose a charge for handling and facilitating transactions between merchants and customers. The rate for this fee also varies greatly across acquirers and industry types, affected by merchant category codes (MCC), the risk appetite of the acquirer and the expected risk of chargebacks or fraud that a merchant can present. These fees cover the costs of various services provided by the processors alongside a markup to ensure that transactions are securely and efficiently completed and allowing the acquirer to profit.

Every time a transaction is made via a card scheme (Visa, Mastercard, etc.), the acquirer pays the cardholder’s bank an interchange fee. The business then pays the interchange fee back as part of its card processing fees.

Blended pricing

Similar to interchange ++, a blended pricing model still deals with interchange, card scheme, and processing fees. However, all three fees become combined into one flat fee for the merchant. The single components are handled in the background by the payment service provider. The primary advantage of this model is its simplicity. The billing process becomes simplified for merchants by providing a consistent fee for each transaction, regardless of the card type or other variables. But this also means businesses become blind to the individual fees behind the flat rate.

This pricing model is usually offered by PSPs that are focused on offering payment acceptance to small/medium enterprises. Typically having lower transaction volumes, these businesses prefer to have simple and predictable models.

The difference between interchange ++ and blended pricing

In contrast to the blended pricing model, the interchange-plus pricing model separates the interchange fees and assessment fees from the processor’s markup. This model provides more transparency but can be more complex for merchants to understand and predict their costs.

Enterprise merchants usually prefer this approach as fees being applied to their businesses are transparent and allow access to more details into strategies that can optimize their payment costs.

Blended pricing models in action

Now that we’ve established the difference, let’s take a look at how PSPs are applying the blended pricing model.

Here are two examples from Stripe of rates for Europe and the United States. A standard pricing model with a mixture of blended fees in combination with additional processing services would look like the following:

Charge type |

EEA |

US |

EEA Consumer Credit and debit cards |

€0.25 + 1.5% | 30¢ + 2.9% |

EEA Commercial cards |

€0.25 + 1.9% | 30¢ + 4.4% |

UK card payments |

€0.25 + 2.5% | 30¢ + 4.4% |

International card payments |

€0.25 + 3.25% | 30¢ + 4.4% |

Link (one-click Stripe checkout) |

€0.25 + 1.2% | 30¢ + 2.9% |

3D Secure authentication* |

€0.03 | 3¢ |

Card account updater* |

€0.25 | 25¢ |

Network tokens |

€0.15 | 15¢ |

Local payment methods |

€0.35 | > 80¢ |

Buy Now Pay Later |

€0.35 + 2.99% | 30¢ + 5.99% |

Disputes |

€20 | $15.00 |

Fraud checks (Radar)* |

€0.05 – €0.07 | 5¢ – 7¢ |

* included with standard pricing, applied additionally for custom pricing. For the comprehensive version of Stripe public pricing look here for Europe and for the United States.

Other costs while processing payments

Aside from costs allocated to pricing models, here are other expected costs in payment acceptances:

- Gateways fees → applied by payment service providers to use APIs and initiate specific actions such as 3DS authentication, authorizations, refunds;

- Risk checks → to combat and prevent fraud, merchants would rely very often on risk engines provided by dedicated solution providers or payment service providers. This is usually a few cents per request.

- Disputes → when a dispute is initiated and reported by a cardholder or an issuer, payment service providers charge dispute fees to handle the specific cases. Those fees are often above 20$ for small businesses.

- Monthly minimum commitments → It is common to see monthly commitments required by payment service providers or dedicated solution providers.

- Payouts → Businesses might need to initiate payout events and transactions to other businesses or payment accounts. This would incur additional costs.

- Foreign exchanges → Services such as Dynamic currency conversion (DCC) or settlement across different currencies can incur in additional hidden costs, or even revenues in some cases.

How to choose the right pricing model

There are a few essential steps to evaluate which pricing model to choose:

- Look at the size of the business – smaller businesses prefer simplicity and blended pricing models. Those can be more predictable and stable over time, requiring less forecasting efforts, at the same time it might be less convenient than choosing an Interchange++ pricing model.

- It’s common nowadays to have a multi-acquirer payment strategy. Therefore consider how much volume is expected to be processed with a single PSP; businesses tend to look into IC++ when volume grows.

- Look at the payment method distribution and geographies. If alternative payment methods are predominant for a specific business or industry, consider focusing on the pricing for those or the payment methods with larger shares instead of specifically looking at cards. If the business is heavily focused on a specific geography then it would make sense to look for a local acquirer in that area to process payments domestically.

- It’s important to go into details, Especially when running an RFP (Request for Proposal). Understand all the additional costs that can be applied by a PSP in both blended and interchange++ pricing models.

- Analyze and monitor costs. Delve into details to benchmark the total cost of payment methods, different acquirers, regions and the impact on profitability for sub-accounts or customers to understand if the business is still on the right pricing model approach.

If you want to learn more about pricing for payments and its best practices, reach out to Congrify or schedule a call today!