The ultimate portal for all your payment analytics.

Congrify offers a simple & easy no-code payments data intelligence & observability solution for payment analytics.

By Marco Conte

Here at Congrify we understand how managing payments can be a hassle. From deciding how to organize payment strategies, choosing and implementing the right PSPs and payment methods, to running operational processes that include organizing data across multiple payment service providers and eventually optimizing payment strategies, the management becomes overwhelming. Learn how to make payments easy to analyze, access, and manage as we dive into an overview of key features and tools in the Congrify online portal.

Best practices for a successful business

Combining years of industry experience and extensive conversations with payment professionals, we have developed the best practices and tools for achieving business success. A key approach is to first have full access and transparency to payment data, ensuring continuous ingestion of diverse data files from different PSPs. Next, unified data models while also preserving the original values for specific data fields, like decline reason codes from PSPs or event types, should be maintained. This strategy ensures consistency across the organization, making it easier to analyze and compare data from different sources. It’s also important to emphasize KPIs fundamental to a business’s success, bringing awareness to critical areas while allowing users to closely monitor data. With all these essentials in mind, we’ve created a comprehensive portal, laying out all the necessary information in one webspace.

Optimizing tools and features

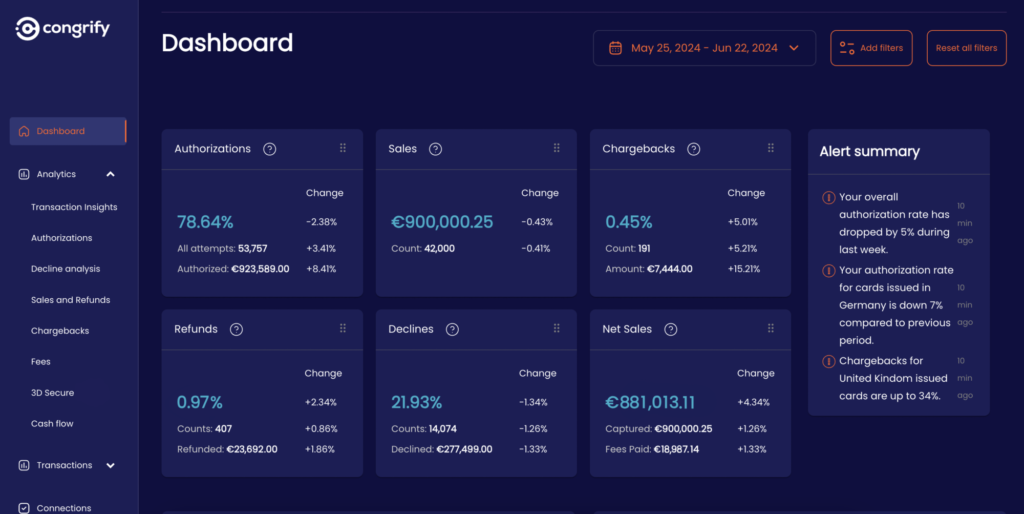

Performance monitoring, analytics, and visualizations are essential parts of understanding how a business is doing. That’s why at Congrify we offer an extensive dashboard, presenting the necessary KPIs for an initial analysis overview, and a ready to use analytics tab, easily allowing deep-dives into the most important aspects of payments monitoring and analysis without any developmental or organizational effort. Congrify’s analytics offer a wide range of tools to help optimize strategy and success:

- Transaction Insights – Gives the possibility to filter across all the different PSP events that have been ingested. By filtering the different attributes this allows users to freely analyze the data in charts and tables.

- Authorizations – A dashboard to monitor the development and changes of merchants’ authorization conversion rates. This feature helps users understand authorizations by comparing payment methods, PSPs, or even country performances.

- Decline analysis – A deep-dive into the reasons behind payment failures, grouping decline reason codes into different categories such as gateway rejections, issuer soft or hard declines.

- Sales and Refunds – A quick overview of sales and refunds performances across all different data categories. This section provides straightforward analyses for issues regarding refunds with spikes for certain payment methods, product categories or customer segments.

- Chargebacks – See how chargebacks and disputes evolve over time, reasons for disputes, dispute performance, and winning ratios of dispute processes, ultimately displaying their overall financial impact.

- Fees – A comprehensive view of all payment costs and fees being charged to a business. These are grouped by different categories from processing fees to card schemes and acquiring fees, even including additional costs from monthly adjustments or chargeback fees.

- 3D Secure – Globally, Strong Customer Authentication (SCA) is a prominent part of payment strategies; this section monitors authentication rates over time, including 3D Secure failure reasons and how exempted transactions perform. This is relevant for businesses trying to leverage exemptions under the PSD2 regulation, such as Transaction Risk-Analysis (TRA).

- Cash Flow – Merchants are not paid in real-time for their transactions, rather in settlement cycles; so it’s fundamental for businesses to know when payments are expected. This section shows the expected and received payouts and differences between the total gross transaction volumes and net received amounts.

Why payment analytics matter

Monitoring and understanding payments is crucial for businesses to ensure financial health, enhance operational efficiency, and improve customer satisfaction. It enables accurate tracking of cash flow, quick identification of discrepancies, and informed decision-making. Additionally, a robust payment monitoring system helps mitigate fraud, comply with regulatory requirements, and optimize financial strategies.

When deciding between buying an off-the-shelf payment solution or building a custom one, businesses must weigh factors such as cost, scalability, and specific needs. Regardless of the choice, the essential requirement is to have comprehensive and user-friendly tools in place. These tools should provide real-time visibility and control over payment processes, enabling users to make informed decisions confidently.

Learn more

Payments can be hard to manage, but utilizing the right resources and insights can be the make-or-break point for a lot of businesses. By leveraging Congrify’s tools, you can delve deeper into analytics while optimizing your success.

Experience convenient access to insights and analytics by scheduling a demo today!